who claims child on taxes with 50/50 custody pennsylvania

However if the child custody agreement is 5050 the IRS allows the parent with the highest income to claim the dependent deduction. Solving your legal problems and putting your needs first are priorities for the Denver child custody lawyers at Littman Family Law and Mediation Services.

Blog Family Lawyer Grant J Gisondo In Palm Beach Gardens

Who claims child on taxes 5050 custody PA.

. You must meet the following qualifications to claim a child on taxes. If parents have 5050 parenting time but one parent contributes significantly more financials that parent may get to claim the child ren a greater percentage for example 2 out of 3 years. Child Tax Credits With 5050 Shared Custody.

A 5050 custody arrangement is clearer and it is socially beneficial for both the ex-spouses and their children. Im not a tax or legal pro so this is just my personal experience. Well what about leap years youre asking yourself.

Who claims the minor child on their income tax in pennsylvania when the parents were never married and have a 5050 - Answered by a verified Tax Professional. Deciding who can claim a child on taxes with 5050 custody can be tricky if youre not aware of the IRS rules. For federal income tax purposes child support is tax-free to the recipient but not deductible by the payer.

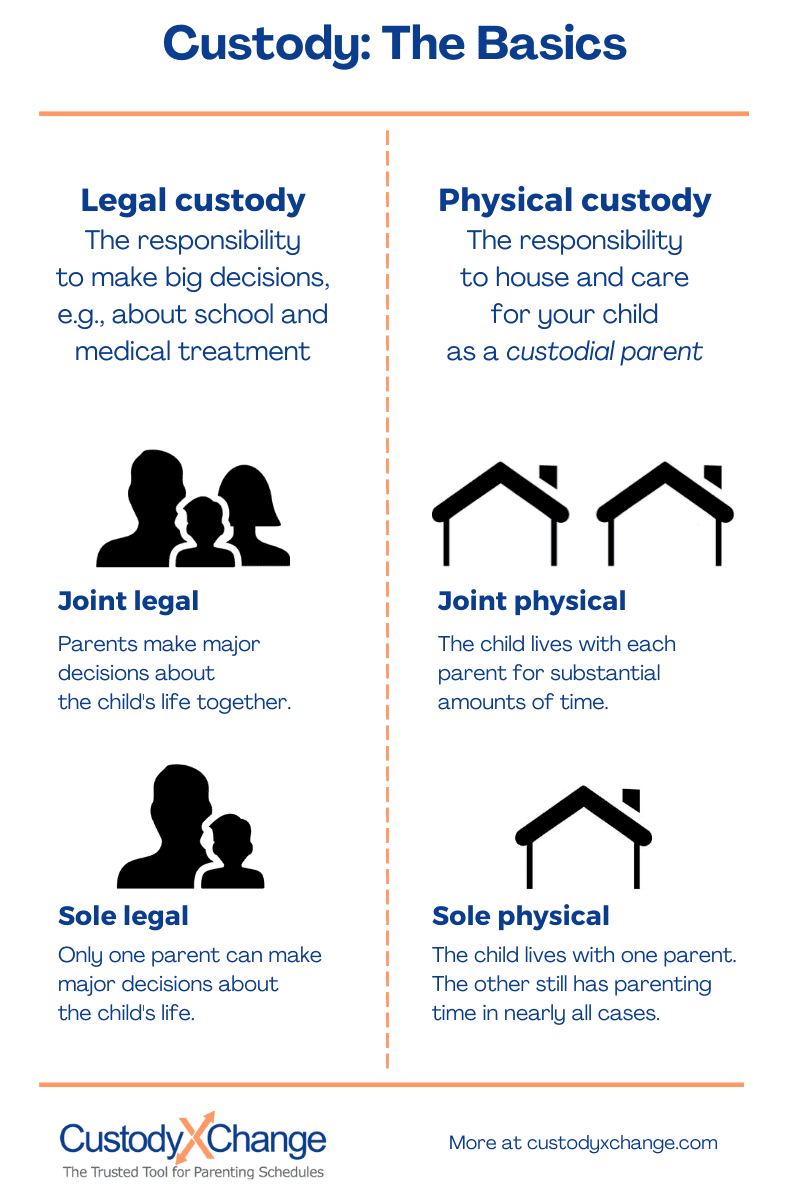

In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. Answer 1 of 6. Learn the circumstances under which a parent must pay child support even if they share custody 50-50 with the other parent from noted PA child support lawyer Lee A.

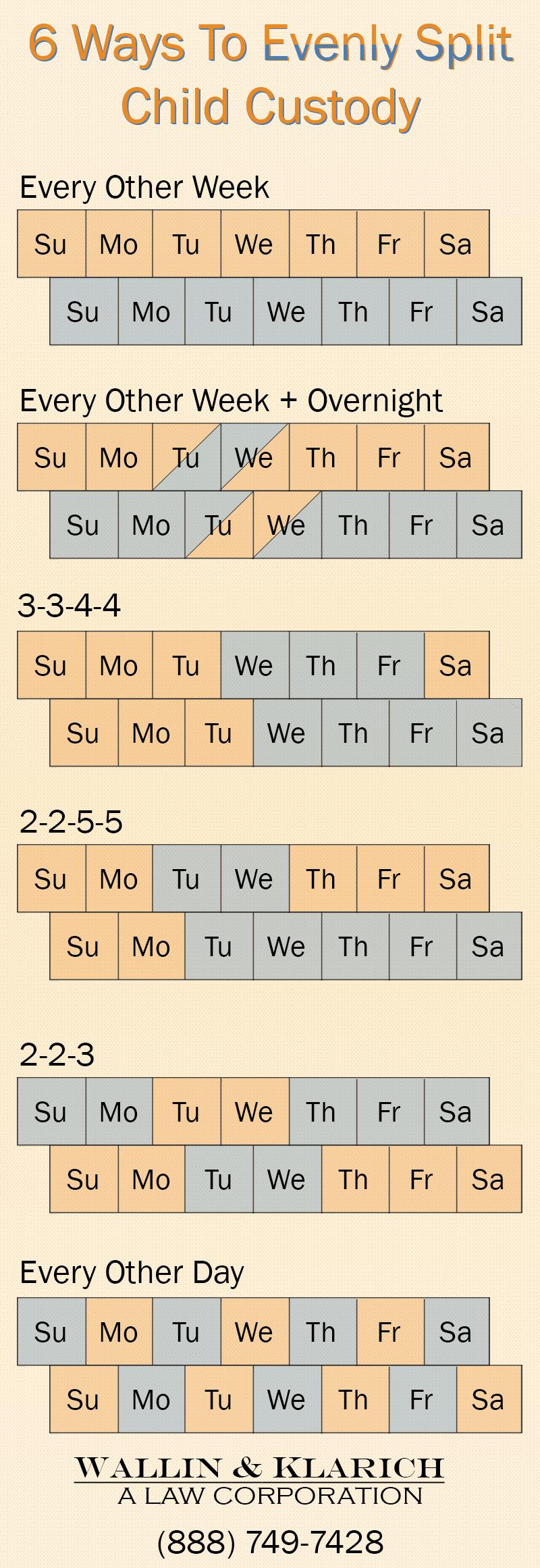

3-4-4-3 Custody schedule Example. For tax purposes the custodial parent is usually the parent the child lives with the most nights. When parents share parenting time equally 5050 one of the two parents must have at least one more overnight than the other because there are an odd number of days in a year 365.

In this way both parents if eligible have the opportunity to. Who Claims a Child on Taxes With 5050 Custody. As a custodial parent who spent the most time with the child during the year you will be entitled to claim Head of Household Earned Income Credit and.

The following arrangements were written into Joint Parenting Agreements during mediation prior to divorce and are from what I understand fairly boiler plate at least in IL. Tax law mentions custodial and noncustodial parents but does not mention joint physical custody or 5050 custody. Once it has been determined which party will receive child support based on the custodial schedule the next step is to determine the monthly net incomes of the parents ie.

The only exception to this is if the court says otherwise or if the custodial parent signs a form called the Release of Claim to Exemption for Child of Divorced or Separated Parents. Who can claim a child ontaxes in a 5050 custody agreement. For a confidential consultation with an experienced child custody lawyer in Dallas contact Orsinger Nelson Downing Anderson LLP.

Heres what it does say. Based off of the 2019 tax filing Mom received one 500 and one 600 stimulus check for the child dependent. Mom and Dad share joint 5050 custody and claim the child on alternate tax years.

The one with 183 overnights is the parent who is entitled to federal. But if the father furnishes over 50 of the childs support he is entitled to the exemption. This parenting schedule is where the child is with Parent A every Monday and Tuesday 2 days and Parent B every Wednesday and Thursday 2 days.

Basically the custodial parent claims the dependent child for tax benefits. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. June 4 2019 317 PM.

I provide more than 50 support and. Yes it is allowed. If there is more than one child the court may divide the children.

Yes if you earn more than the childs other parent you will need to pay child support in Pennsylvania even if you have 5050 custody. In this situation when Dad files the 2020 tax return claiming the child as a dependent will he be allowed to get a duplicate of the 500. Typically when parents share 5050 custody they alternate between odd and even years on which parent claims the child.

But there is no option on tax forms for 5050 or joint custody. The child support lawyers at Schwartz Fox Saltzman. A 5050 custody arrangement is clearer and it is socially beneficial.

The most important thing is to make sure youre staying on the right side of the tax code to avoid an audit. This usually means the mother because she most often gets primary physical custody. The Quick Guide to Dependent Tax Claims in 5050 Custody.

Certain credits and deductions may have slightly different rules The child must have any of the following relationships to you. In this case the child tax credit is available to the parent who earns the higher income in that year. Both of you could claim the child but not for the same tax benefit.

5-2-2-5 Parenting Schedule- Another common 5050 child custody schedule is a 5-2-2-5 schedule. My soon to be ex husband and I have decided to go for shared parenting with an exact 50 split of the time with our little daughter so there is no primary care give. The Quick Guide To Dependent Tax Claims In 5050 Custody.

Therefore the following questions and answers may help determine who can file their. However it may make the tax waters a bit murkier than they were before the divorce. He must file with his tax return IRS Form 8332 Release.

Contact an Experienced Attorney. Our firm has more Super Lawyers than any other organization in the Lone Star State. In most cases one parent will have 183 overnights and the other will have 182 overnights.

We use cookies to give you the best possible experience on our website. Call 303-832-4200 or contact us online for a confidential no-obligation consultation. In a leap year that is a year that has 366 days parents who have 5050 custody will likely have the exact same number of overnights.

Im divorced with one. Generally IRS rules state that a child is the qualifying child of the custodial parent and. The weekends from Friday through Sunday would be alternated 3 days.

Which parent gets to claim the child on taxes. In the event of a 5050 custody schedule child support in Pennsylvania is payable to the parent with the lower income by the parent with the higher income. In the event of a 5050 custody schedule child support in Pennsylvania is payable to the parent with the lower income by the parent with the higher income.

So one parent claims for the child one year and the other parent the next year. We strive to use our skills experience and resources to bring your case to the best resolution possible. While you can work out something with the other parent on claiming dependents thats not always a smooth process.

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

What Is Joint Custody All Products Are Discounted Cheaper Than Retail Price Free Delivery Returns Off 65

What Is Joint Custody All Products Are Discounted Cheaper Than Retail Price Free Delivery Returns Off 65

How Child Support Is Calculated In Pennsylvania Cooley Handy Blog

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

50 50 Residence What Does This Look Like Ourfamilywizard

What Is Joint Custody All Products Are Discounted Cheaper Than Retail Price Free Delivery Returns Off 65

Custody Does Matter When Filing Your Taxes 2020 Update Andalman Flynn Law Firm

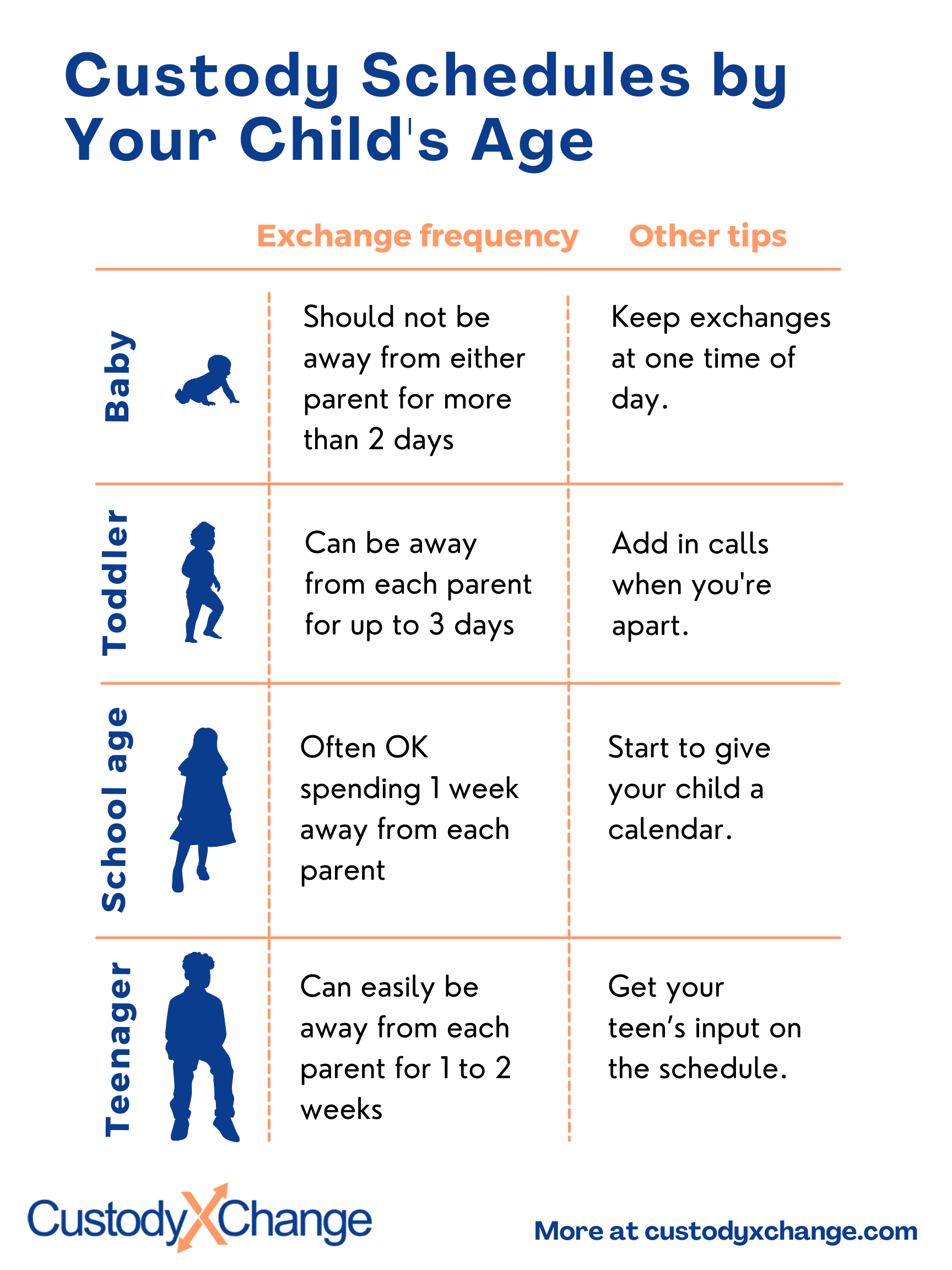

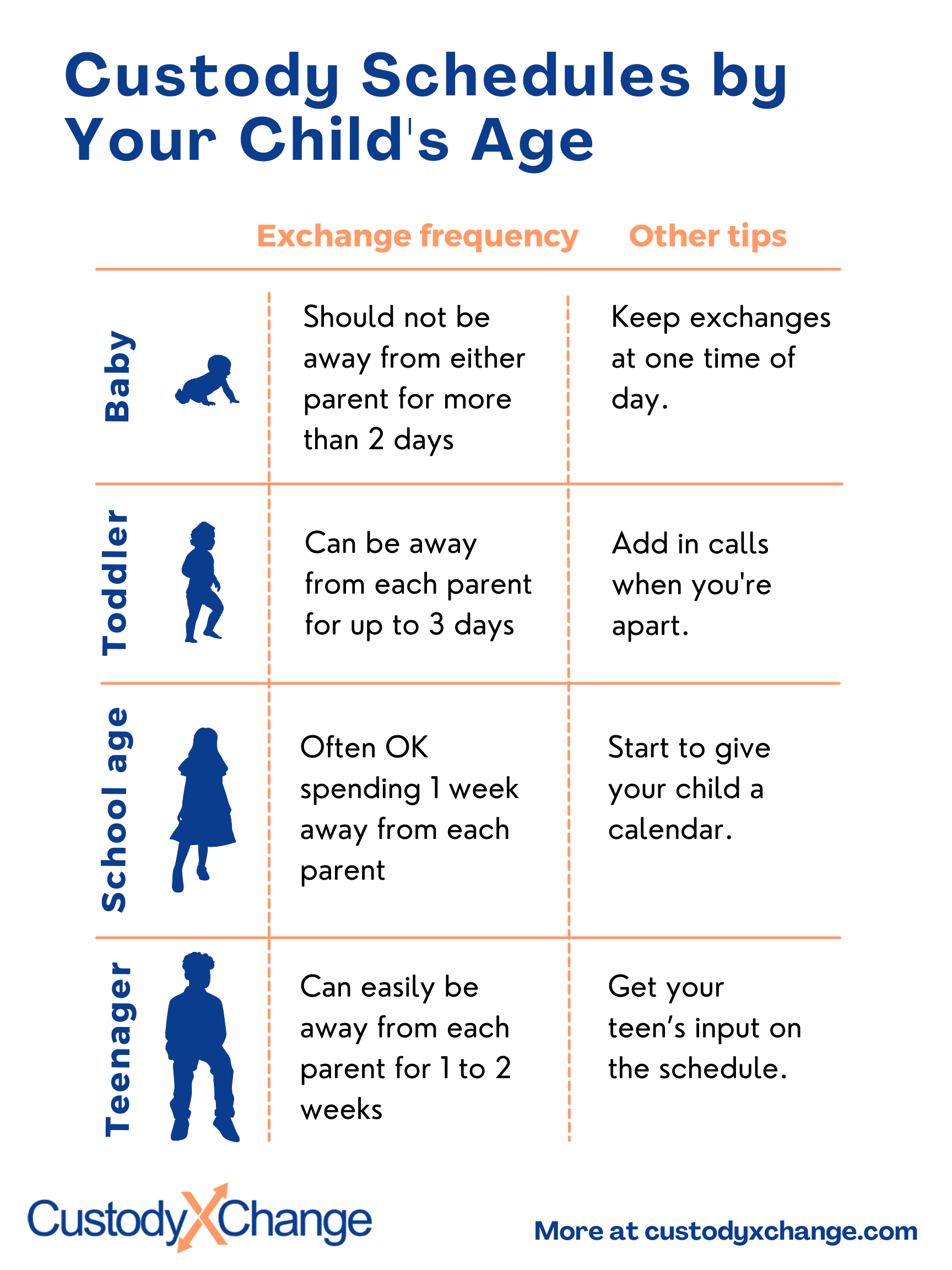

Infant Baby Parenting Plans Custody Schedules What Is Best

Joint Legal Custody Defined Advantages Disadvantages

Dice Ruby Discovered In Virginia Marriage Records 1936 2014 Marriage Records Marriage Records

Do I Have To Pay Child Support If I Share 50 50 Custody

Pennsylvania Child Custody Deductions And Your Tax Return

50 50 Residence What Does This Look Like Ourfamilywizard

Florida 50 50 Parenting Plan 50 50 Custody And Child Support

Child Support Calculator Ny Calculating Child Support In Ny

Do I Have To Pay Child Support If I Share 50 50 Custody

Florida 50 50 Parenting Plan 50 50 Custody And Child Support